Guides and reports

Buy now, pay later: how can it work for my business?

Learn about the potential benefits of buy now, pay later (BNPL), if it's right for your business, and discover some of the BNPL solutions out there.

The ‘buy now, pay later’ (BNPL) phenomenon has taken the world by storm. Although the concept has existed for well over a decade, BNPL boomed during COVID due to the rise in financial instability and online shopping.

Promising businesses increased conversion rates, average order values, and repeat purchases, implementing BNPL seems like a no-brainer.

However, buy now, pay later solutions seem to work better for some businesses than others. In this article, find out whether BNPL is right for your business and which BNPL vendor to choose.

But first, what exactly is buy now, pay later?

Buy now, pay later, or BNPL for short, is a form of financing that lets customers pay for something over time. It generally can be categorised into two types: invoicing and instalments.

Invoicing

The customer checks out without paying anything and needs to repay the full amount in 14-30 days. This is a zero interest option and most popular in Europe.

Instalments

The customer repays the balance in bi-weekly or monthly payments. For some BNPL solutions, a deposit is collected at time of purchase. This is most popular in North America.

How does BNPL work?

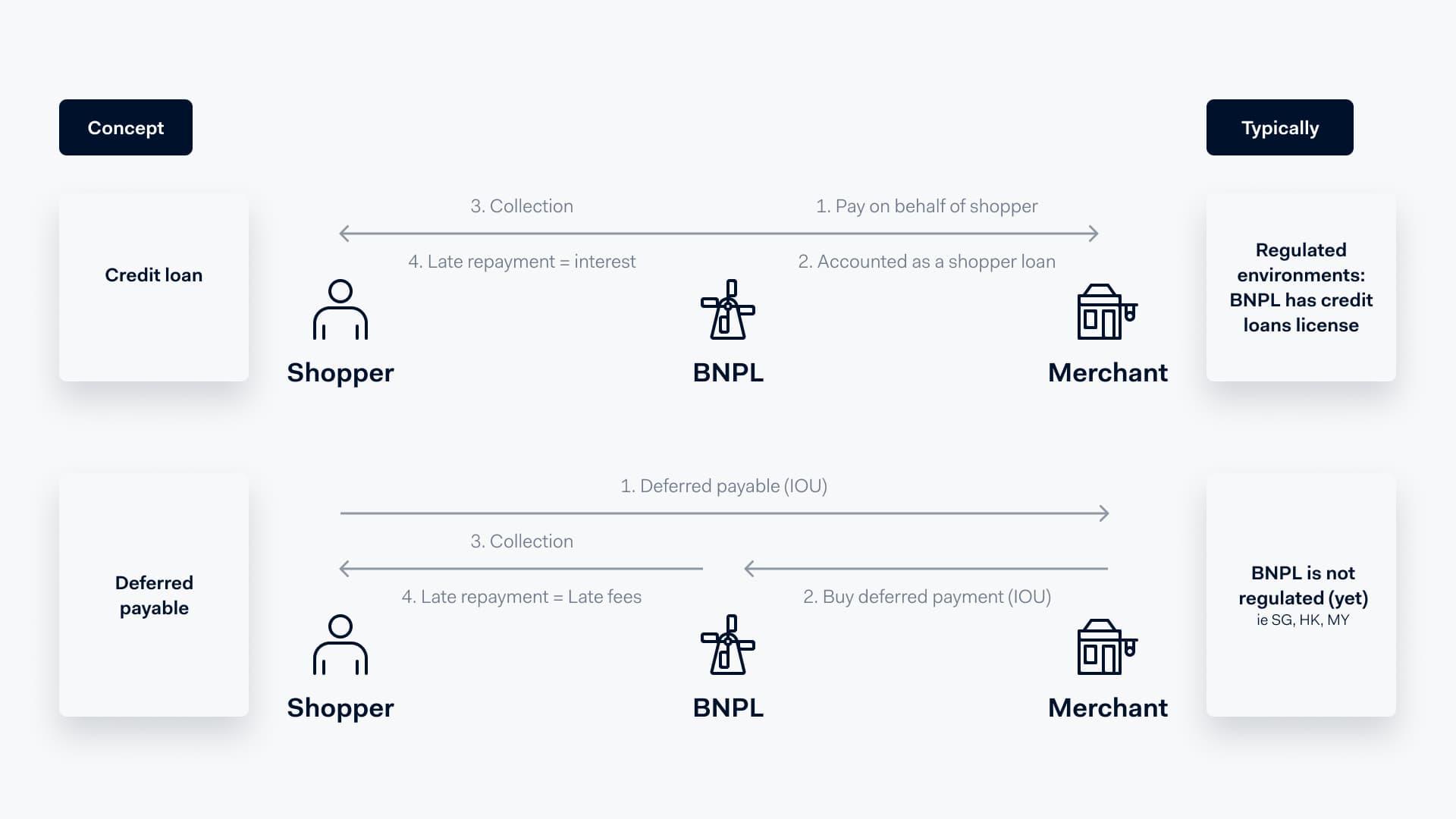

Very simply, the customer makes a payment via a buy now, pay later payment method. The BNPL provider pays the merchant the full purchase amount. The customer then repays the BNPL provider either the full amount or in instalments.

On a more detailed level, a repayment works differently depending on if it’s classed as acredit loanor adeferred payable. With a credit loan, BNPL is accounted for as a customer loan. With a deferred payment the merchant buys an “I owe you” (IOU) from the BNPL provider. This dfference can affect the repayment terms for the customer and the contracting terms for the merchant.

BNPL providers have different terms and conditions on certain topics, including:

- Repayment periods.Customers either need to make the repayment in full at the end of the month (like credit cards), or pay in instalments on a weekly, biweekly, or monthly basis.

- Late fees.There are a range of associated fees when a customer doesn’t pay on time. For instance, interest or late fees, monthly fees, or account reopening fees.

- Payment channels and types.They also cater to different channels and payment types, like in-person, online, and recurring payments.

- Marketing requirements.Some expect advertisements on the merchant’s website, like promo banners, and marketing budget allocation.

Is buy now, pay later right for your business?

Offering a buy now, pay later solution can be advantageous, but it can work better for some businesses than others. Pinpointing exactly where a BNPL solution can help your business can ensure you see the benefits you expect. Below you can see how well your goal lines up with what a BNPL solution can offer.

| Your goal | Does BNPL help? |

|---|---|

| Attract new customers | Yes |

| Increase ATV | Yes |

| Increase purchase frequency | Yes |

| Increase conversion and authorisation rate | No |

| Lower cost with payment method | No |

If you have the resources available, and are unsure if a BNPL solution will benefit your business; test it out. A test run with an implemented BNPL solution can help to show whether it has the desired impact with your customers and resonates well with your audience. With Adyen, you can quickly turn on and off and test different payment methods through one integration.

Buy now, pay later apps and websites

The next step, once you’ve decided to implement a BNPL solution, is to pick one that fits best with your business.

BNPL solutions have different settlement delays and can impact different performance metrics like conversion rates, average transaction value (ATV), and authorisation rates. Adding new payment methods can also cannibalise existing ones. It's a good idea to monitor these metrics when you go live with a BNPL solution to understand the impact.

To give you an idea of the solutions out there, here are the most popular buy now, pay later companies globally:

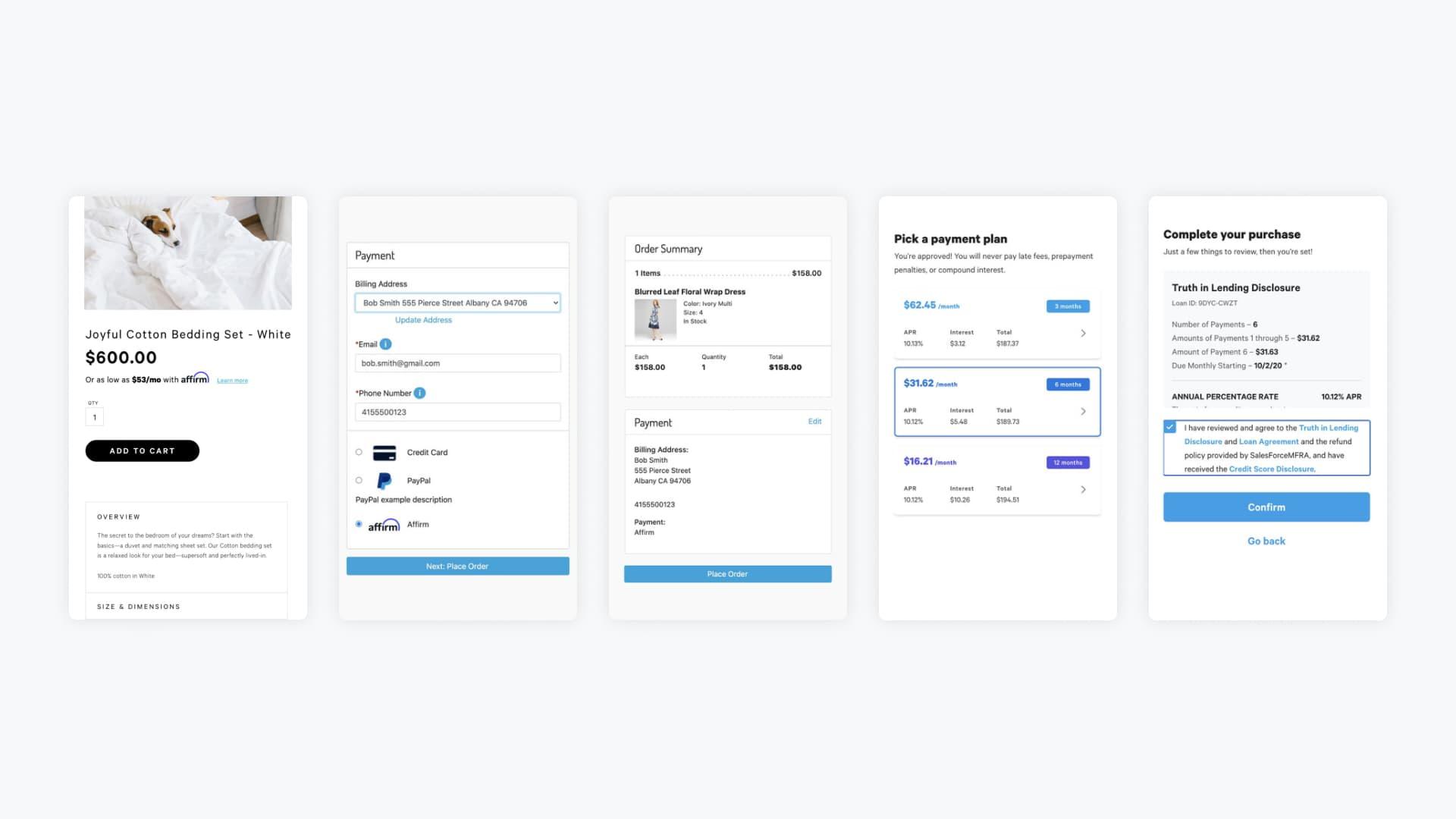

Affirm

| ATV | Repayment period | Financing length | Interest |

|---|---|---|---|

| High | 4 instalments | Short term | None |

| High | Monthly | Long term | 0-36% |

Affirmpartners with over 6,000 retailers in the US across categories like apparel and accessories, beauty, home and lifestyle, and electronics. They offer flexible financing programmes for businesses of all sizes, from mass retailers to local shops.

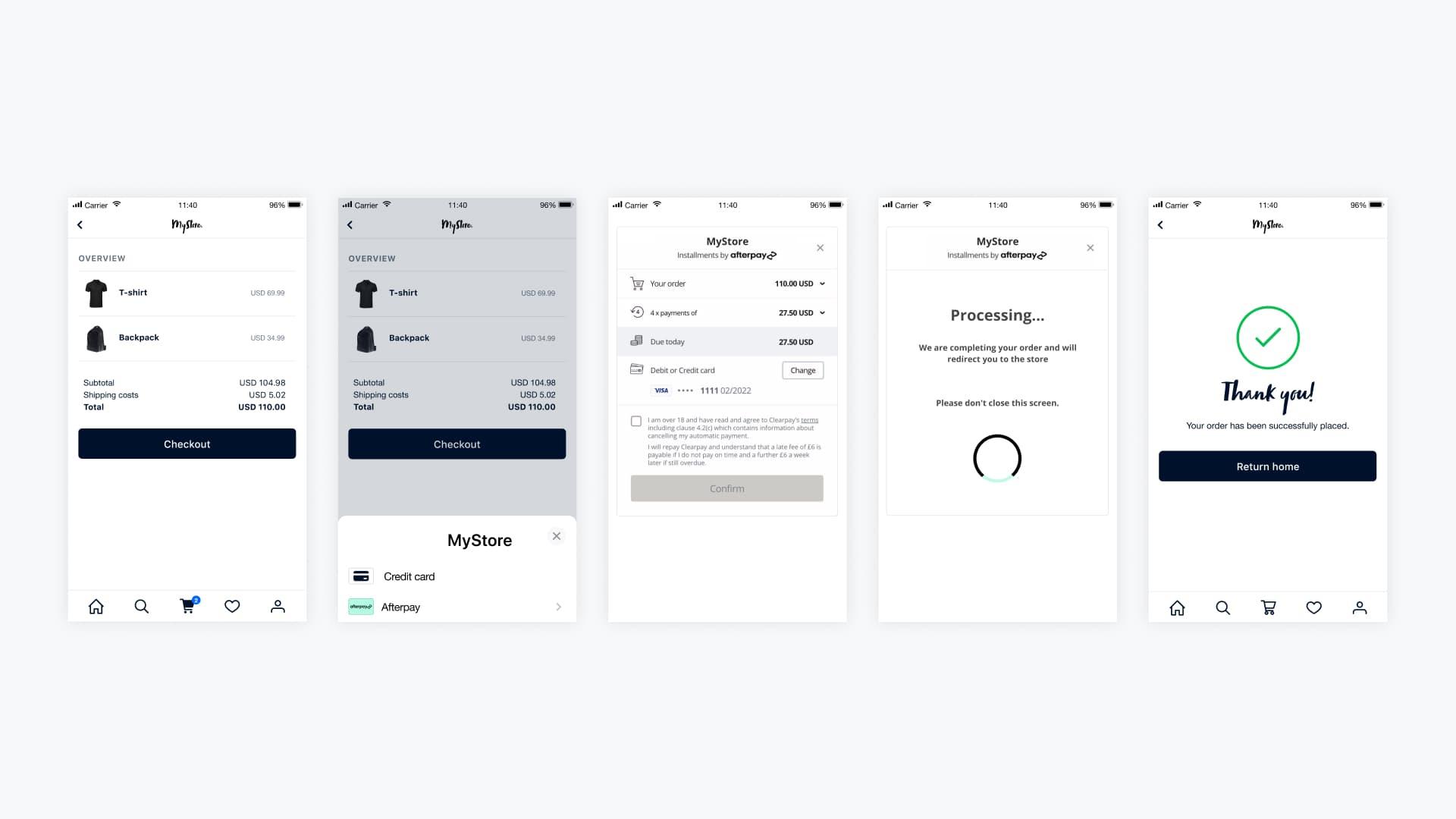

Clearpay & Afterpay

| ATV | Repayment period | Financing length | Interest |

|---|---|---|---|

| <US$2000 | 4 instalments | Short term | None |

Originally from Australia and known as Afterpay there, the US and Canada, in the UK, France, Italy and Spain it operates under the brandClearpay. It offers shoppers the option to pay in four interest-free instalments and promise high authorisation rates.

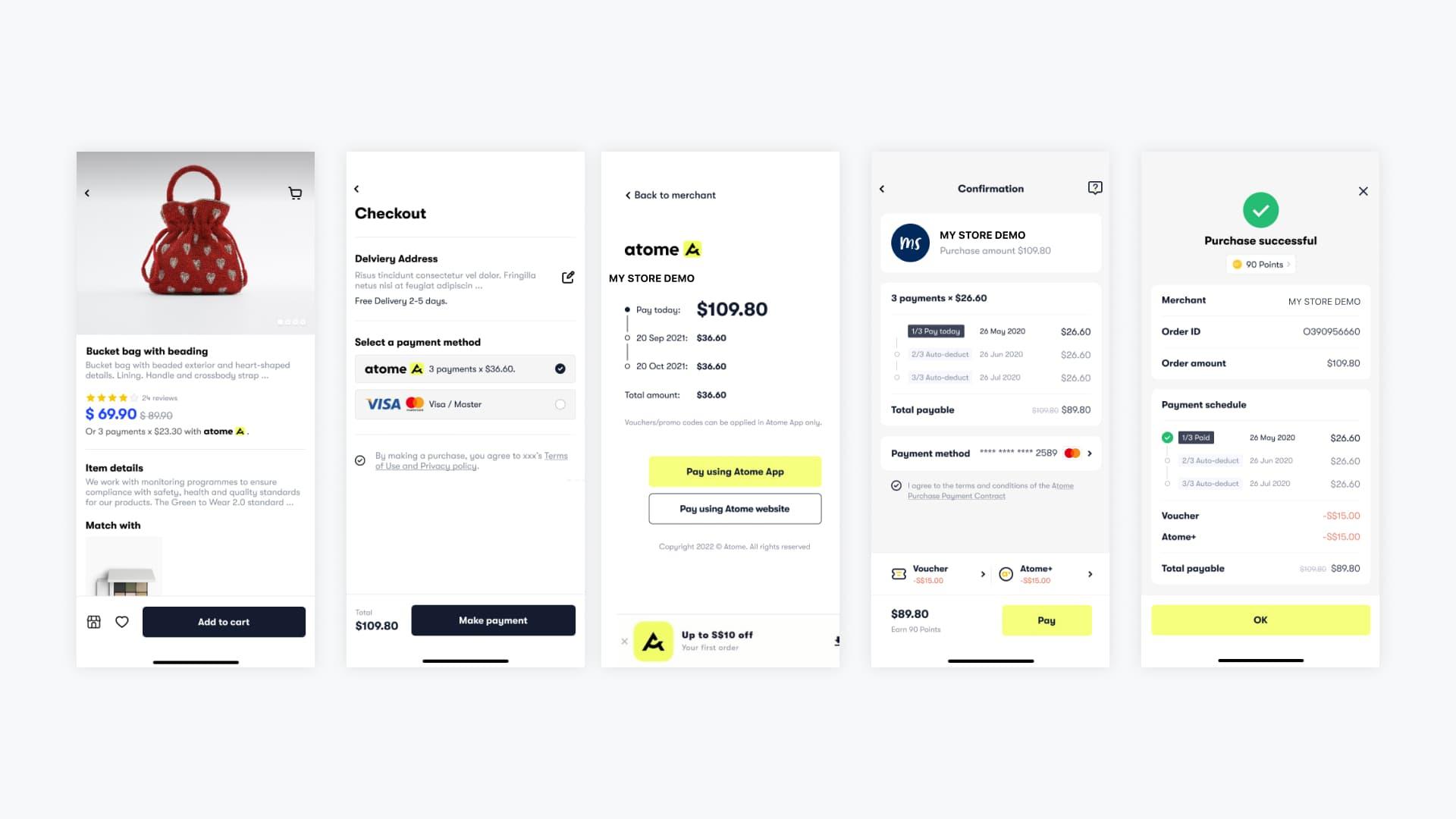

Atome

| ATV | Repayment period | Financing length | Interest |

|---|---|---|---|

| <US$300-2000* | 3 instalments | Short term | None |

* The ATV maximum for Atome varies based on the market and card type. Merchants can request for higher transaction limits, subject to Atome approval.

Atomeis available in Singapore, Hong Kong, and Malaysia with Adyen and is expected to expand into more countries soon. It supports both ecommerce and in-person (dynamic QR) payments. Merchants are settled in full upfront, while shoppers pay 0% interest instalments.

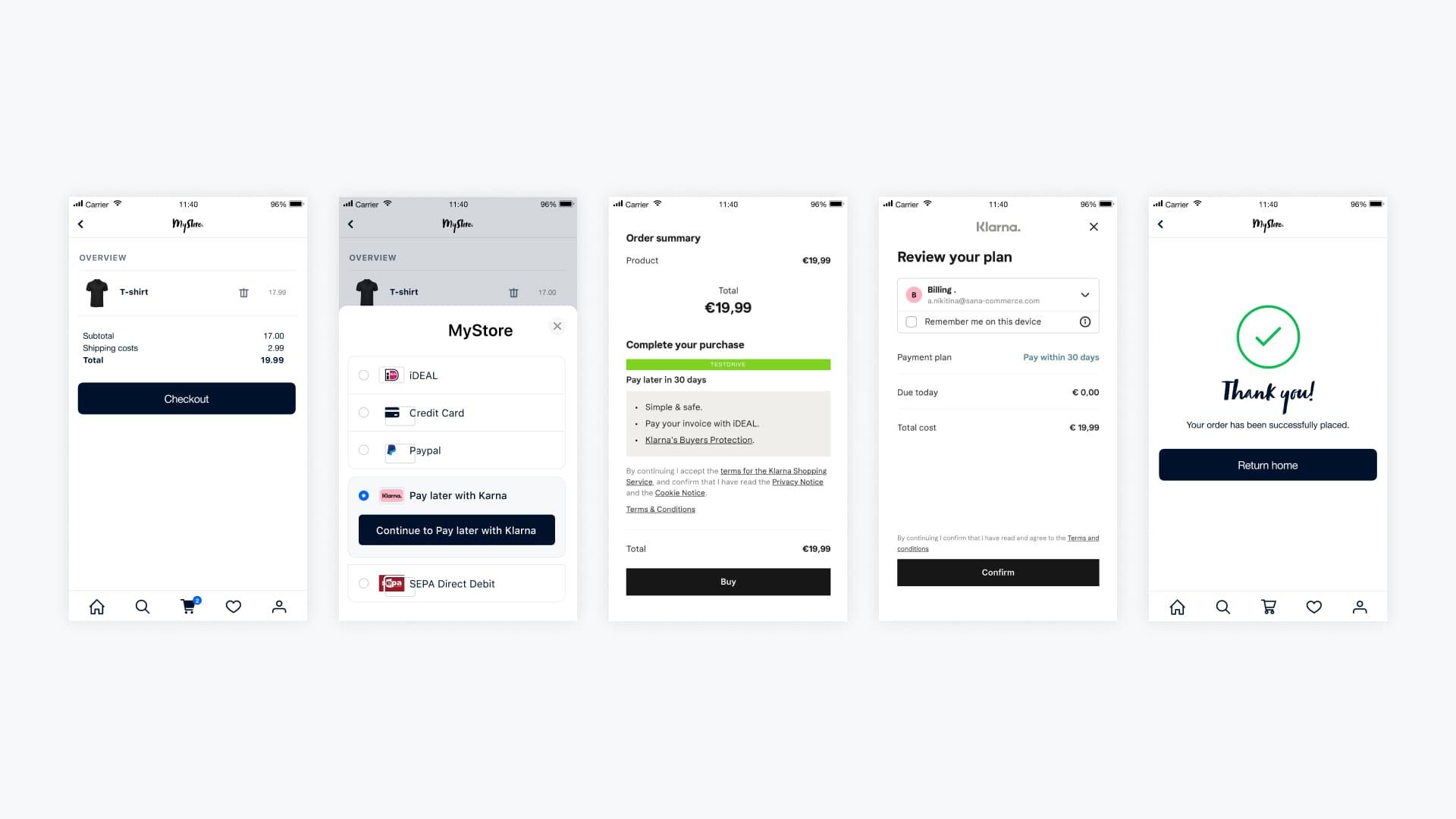

Klarna

| ATV | Repayment period | Financing length | Interest |

|---|---|---|---|

| <US$1000-$3000* | Full repayment, 4 instalments, 30 days | Short term | None |

| High | Up to 36 months | Long term | 0-19.99% |

* The ATV maximum for Klarna varies based on the market.

Klarnais one of the world’s largest buy now, pay later providers with strong brand recognition in the EU and growing presence in the US and APAC. Boasting over 140 millions users, Klarna accepts both one-off and recurring payments.

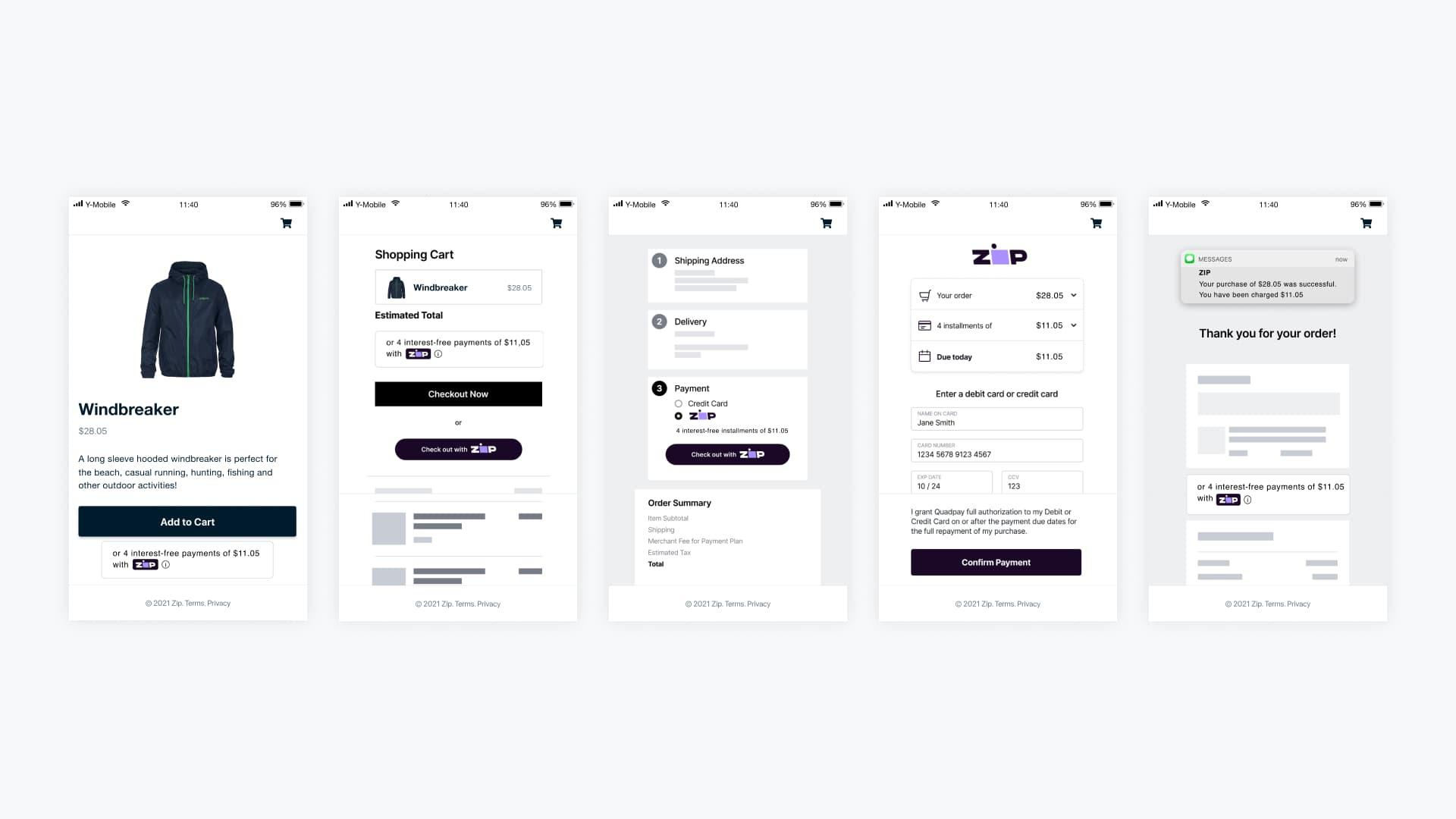

Zip

| ATV | Repayment period | Financing length | Interest |

|---|---|---|---|

| <US$1000 | Flexible repayments | Short term | None |

Zipis one of the main 'buy now, pay later' services across a number of countries including Australia, New Zealand, the United States (formerly QuadPay), and Canada. They provide interest-free purchases both online and in-person, as well as an open-loop virtual credit card solution in Australia.

BNPL is still evolving

With a buy now, pay later solution, the payment experience can become more seamless and draw new audiences. The BNPL market is still evolving with new solutions made on a country to country basis.

With a multitude of options available, it can be difficult to navigate the BNPL stage. Check out ourpayment method explorerto easily compare and choose a buy now, pay later solution fit for your business.

Discover more buy now, pay later solutions in our payment method explorer

Go to Explorer