Podcasts and webinars

Delegated authentication: Reduce friction and increase conversion with better authentication experiences

Learn about delegated authentication and how it can benefit your online payments.

Today’s global digital economy increases the need to verify customers and prevent fraud without jeopardising conversion rates.

Strong Customer Authentication(SCA) requirements solve this challenge by reducing fraudulent transactions and are mandatory in regions like Europe and countries in APAC, such as India, Australia, and Malaysia.

When done inefficiently, authentication can lead to friction in the payment process, negatively impacting customer experience and conversion rates. This happens when the focus is solely on security, and customer experience isn’t taken into consideration.

Delegated authentication has emerged as a solution that contributes to optimising authentication experiences, especially for returning shoppers. With delegated authentication, you can create a safe and seamless experience and increase conversion rates.

What is delegated authentication?

Delegated authentication is when you let another party manage the authentication process. An external platform verifies the user’s login credentials and can link and recognise their identity across many different systems. One example of this is single sign-on (SSO), which allows users to access multiple systems with a single ID.

Delegated authentication in payments

Three parties are involved in the payment authentication process: the issuer,the acquirer, and the card schemes. The issuer is the customer’s bank, which manages the authentication process. The acquirer sends the relevant payment information to the issuer so that it can verify the transaction. In some cases, the acquirer is also the business’s payment service provider. Schemes are responsible for generating and validating the proof of authentication together with the issuer.

With delegated authentication, the authentication that the issuer usually performs is passed over to the acquirer. This allows the acquirer to control the process and its quality, improving the experience and reducing friction.

Benefits of delegated authentication

Delegated authentication is one way to increase security while improving the authentication experience. This results in higher conversion rates whilereducing fraud.

Here are some of the benefits:

- Reduce drop-off rates

- Increase conversion

- Provide a seamless experience

- Reduce fraud with a secure authentication process

- Reduce latency

How does it work?

The process can differ depending on whether you’re a first-time or recurring user.

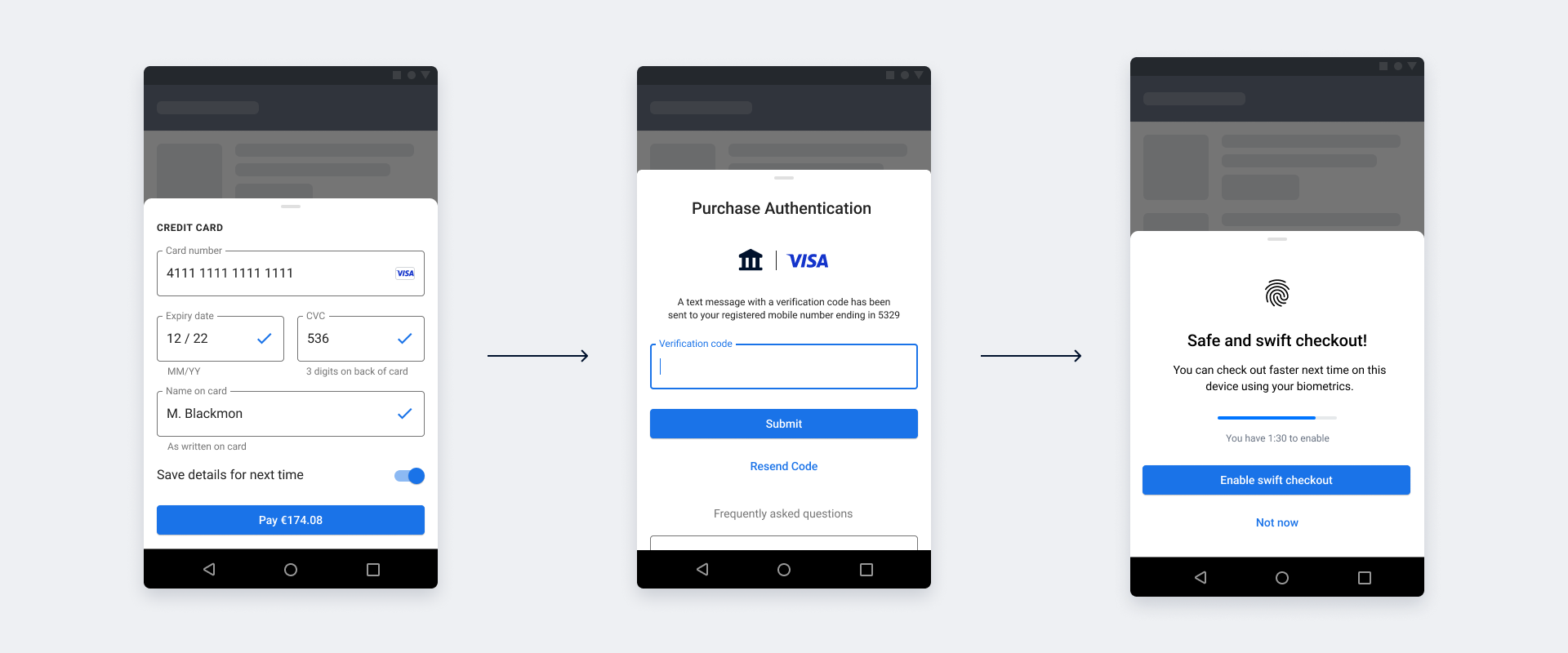

Enrolling first-time users:

- Enter card details.

- Connect the card by verifying through3D Secure.

- Connect the device by verifying through delegated authentication (using biometrics).

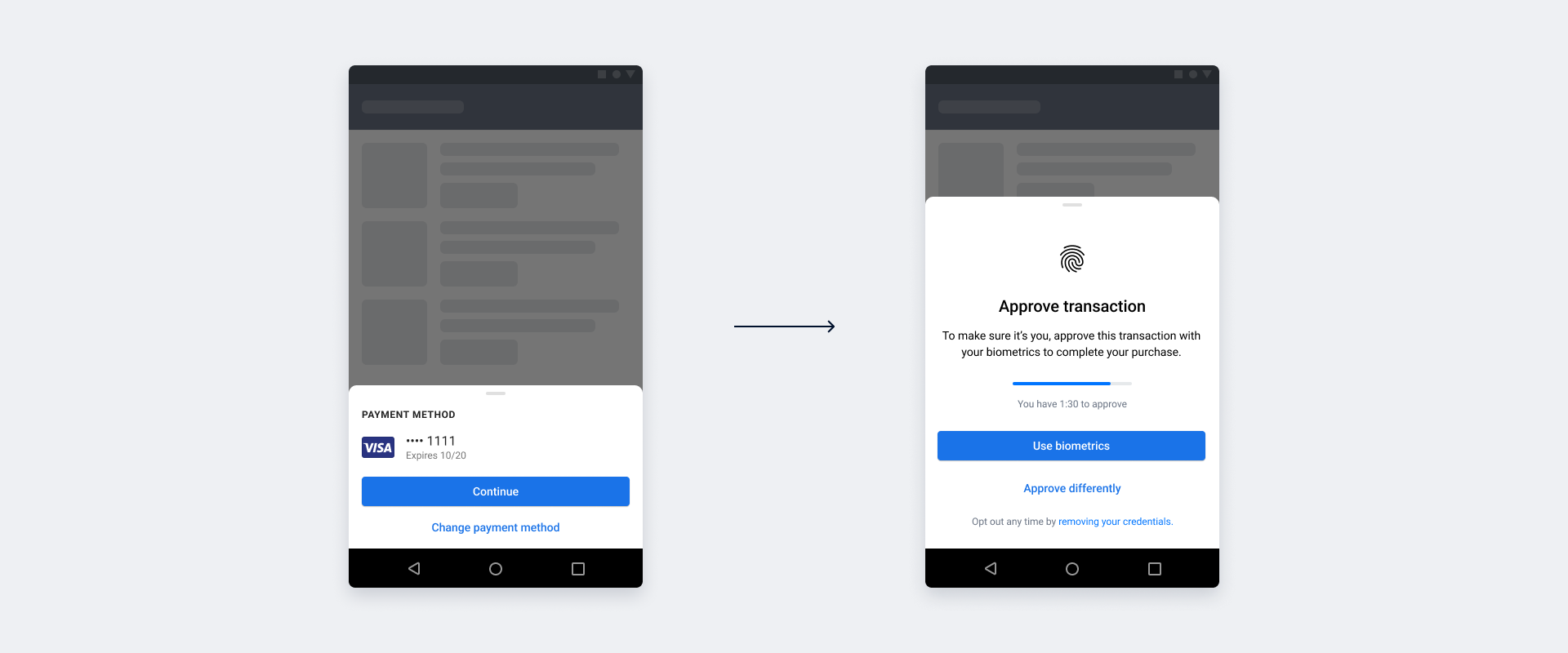

Authenticating recurring users:

- Choose the option “use stored card details”.

- Verify through delegated authentication (using biometrics).

Reduce friction with Delegated Authentication

At Adyen, we combine the security aspect with the customer experience to optimise the overall authentication process and increase conversion. This creates a balance between convenience and security.

Delegated Authentication is a feature that’spart of our authentication solution. It allows us to fully authenticate the customer on behalf of the issuer, providing a seamless cardholder experience. By controlling this process, we can preserve the standard of our online payment experiences and keep customers on the checkout page. We can recognise already-authenticated customers and provide them with a better experience, which reduces drop-offs.

Delegated Authentication technology is provided in regions where SCA is mandated by thePayment Services Directive 2(PSD2).

Ready to take your authentication experience to the next level? Learn morehere.