Guides and reports

3 reasons your SaaS platform needs an embedded finance strategy

Integrating embedded financial products into your platform will increase profitability, stickiness, and help you prepare for the future of finance.

Roiling tides rock all boats. With uncertain economic horizons, SaaS platforms can help small to medium-sized businesses (SMBs) simplify operations even further. By offeringembedded financial products(EFP) directly to users, your platform will let users run their finances where they run their business while simultaneously diversifying your revenue strategies.

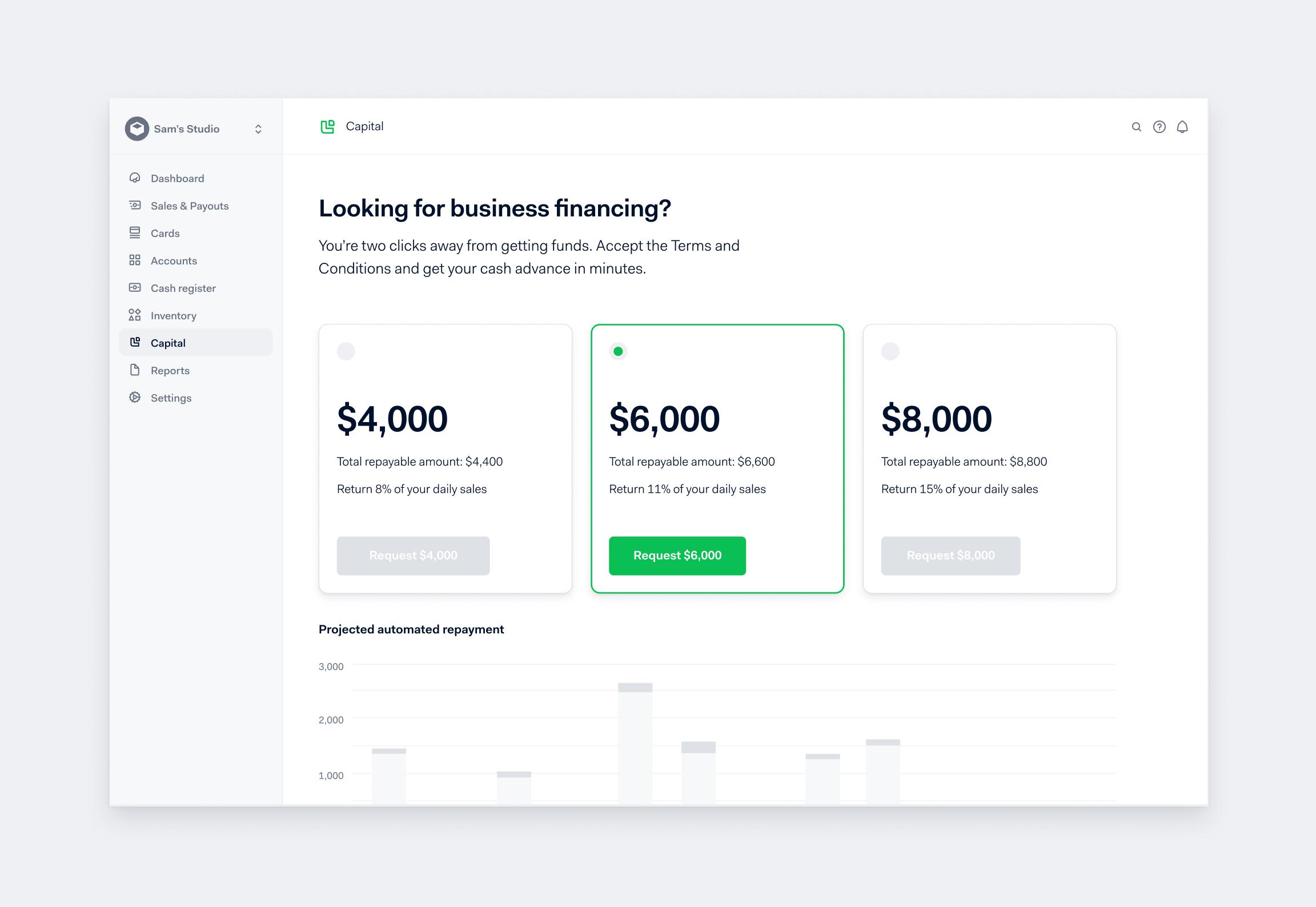

Embedded financial servicesenable SaaS platforms to meet the financial demands of SMBs that traditional financial institutions can’t match. Embedded finance solutions equip platforms to offer business bank accounts, business financing, and card programs tailored to users’ needs.

Research conducted in partnership with the Boston Consulting Group (BCG) shows that SMBs are increasingly ready to embrace financial services from non-traditional bank entities. BCG market research shows that platform adoption currently ranges between ~75% and ~85% in the markets assessed, up from ~30% in 2018. This will be the next frontier of financial technology. As more SaaS platforms embed financial products, they will displace the need for traditional banking. Now is the perfect time for SaaS platforms already embedding payments to consider stepping into financial services.

1. Increase profitability within your existing infrastructure

Many SaaS platforms likeeBayandLightspeedhave seen the success ofembedded paymentsin increasing stickiness and revenue. The opportunities with embedded finance are even greater—you can offer financial products that your users want while monetizing them as you see fit.

When entering a downturn, acquiring new users can become more of a challenge, and generating additional revenue from your current users becomes essential. With huge opportunities in cash advances, business accounts, and card issuing, you can help users in uncertain economic times by offering additional support. Platforms that adapt now will capture a greater share of future revenue from embedded financial services.

2. Increase stickiness to your platform

SMBs grapple with a mountain of paperwork when looking for financial services. They deal with banks that don’t know their business and are slowed down by legacy infrastructure.

Adopting embedded payments will strengthen bonds with your users. You’ll be able to provide seamless cashflow, preferred payment methods, and integratedunified commercesolutions. These benefits will trickle down to your user’s relationships with their customers. As their experiences improve, those benefits can directly be attributed to your platform.

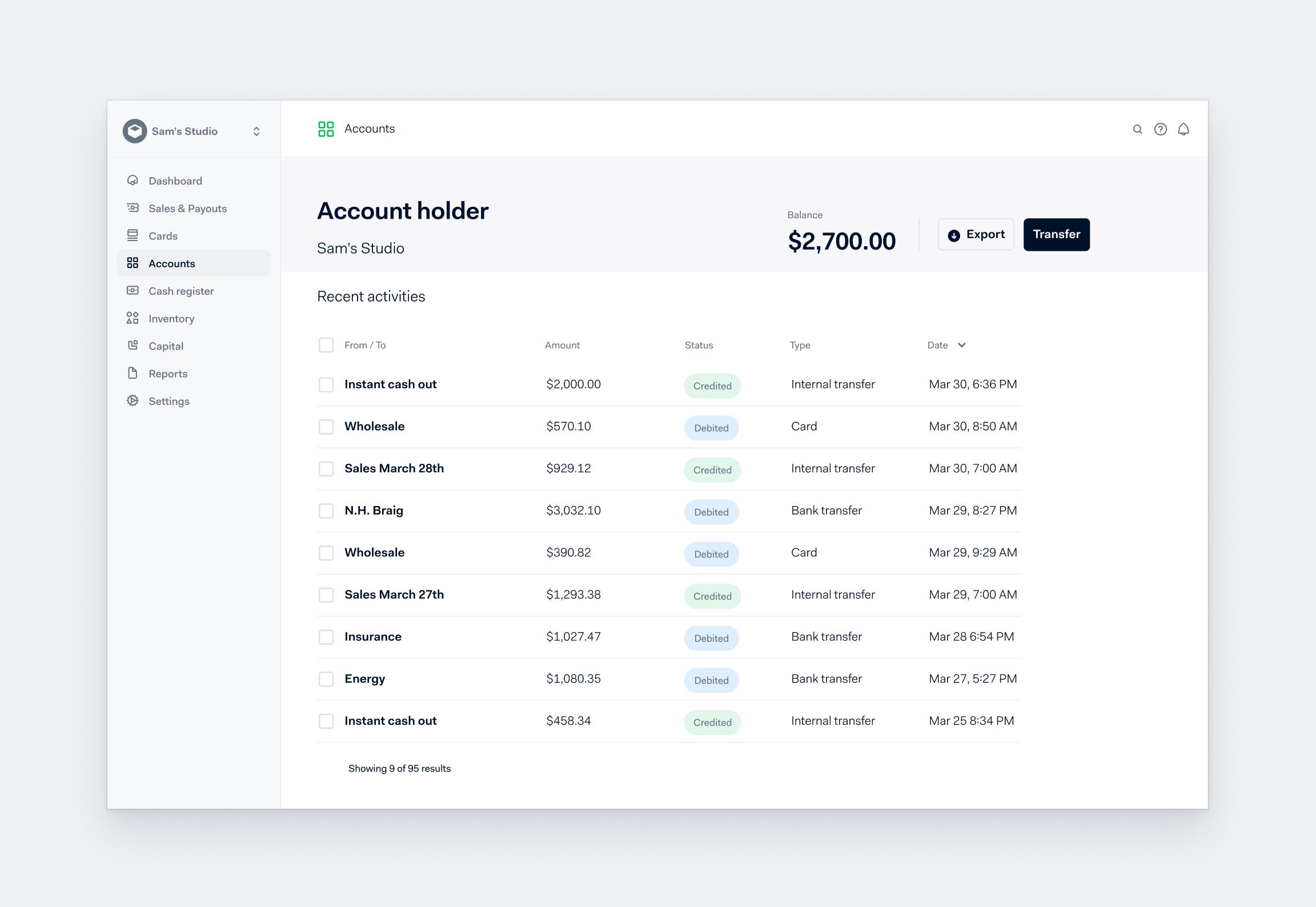

Adding embedded financial services further increases stickiness. Offering a business bank account will allow your users to run their finances on the same platform they do business, and this will give them instant access to funds. Since you know the ins and outs of their business finances, their lives instantly become easier with streamlined and select automated operations.

Embedded payments is the easiest way for your SaaS platform to get a foot in the door of embedded finance. Thetransition to embedded financecan seem daunting, but it’s worth it. Once your users experience the benefits, it’ll be hard for them to leave.

3. Prepare for the future of finance

Embedded financial services are quickly becoming a major competitive advantage for platforms, with over 60% of SMBs showing interest in financial services embedded within a platform. And as more platforms turn to embedded finance, SMB users will get more comfortable using non-traditional banking options.

You want to get ahead of this trend to retain your current users and attract new ones. Financial products are the gateway to becoming a one-stop shop for your users, will give you a major competitive edge, and prepare your platform for the future.

Take the next step

Being ahead of the curve in embedded payments and financial services will attract new customers and increase loyalty within your existing base. As you hit growth capacity in your industry, adding financial products to your platform will unlock new ways to service your users, increase stickiness, and prepare you for the future.

Don’t be left behind as seas get choppier. A sturdy forward-looking approach will make all the difference.

Embedded Finance Report

Insights into the products with strongest SMB demand, quickest path to market, and revenue uplift potential of up to 70%.

Download the insights