Guides and reports

Canada Retail Report: Payments Trends for 2022

Insights to shape, grow, and realize your retail ambitions for the year ahead and beyond.

When you expect the unexpected, you can set your business up to weather turbulent times. If the past few years of the global pandemic have done anything, they’ve proven that adage true. When it became clear that the retail, hospitality, and food and beverage (F&B) sectors were about to take a big hit due to restrictions, businesses worldwide took the opportunity to adapt to create flexible, tech-driven experiences that blurred the lines between sales channels.

The result? In our2022 Canadian Retail Report, we've found that companies who unified their commerce and payments across channels have come out of the pandemic stronger than ever. By breaking down internal and technological barriers with cross-channel payments, companies are facilitating increasingly non-linear customer journeys – and setting a new standard for the post-pandemic customer experience along the way.

We've taken a closer look at the most pressing industry trends and how they will influence current and future digital strategies for the Canadian market. Here are our five top key takeaways.

1. The time to invest in digital transformation was yesterday

Whether or not to invest in digitization is no longer a question. The need to make products available with limited access to brick-and-mortar stores has seen many companies prioritize digitizing operations across the business, with the goal of connecting systems and increasing agility. Payments are increasingly included in this strategy, from linking frontend sales channels to integrating payments with backend inventory management and supply chains.

Companies who have embraced the opportunity of digital transformation during the pandemic have come out on top. Our research shows that those who connected their payment systems to other parts of their business have seen an increase in growth globally of 9% over those who haven't, and are expecting substantial additional growth in the next year.

The opportunity and necessity of breaking down silos and integrating operations into the larger customer experience are felt across the board. Within Canada, those who adopted a tech rollout throughout the pandemic increased efficiencies across their entire business, including CX, supply chain and inventory management, as well as increasing merchants’ growth projections by 25%.

"We are constantly rolling out new innovations, so it’s clear to our customers that we’re on top of things. This is really important to our brand. We put a lot of work into setting up our own ecommerce platforms and ensuring we had the infrastructure in place to manage orders and deliver efficiently."

2. Flexible customer journeys are the future of retail

As the lines between on- and offline life continue to blur, the advantages of delivering a unified shopping experience have become evident to consumers and merchants alike. Customers have taken to flexible, non-linear journeys like an octopus to water, with all eight legs reaching for a different touchpoint. The convenience of click-and-collect or curbside pickups cater to goal-oriented customers, while brick-and-mortar experiences are still available to those that want a more immersive experience.

We've found that 61% of consumers think retailers should continue to deliver the same cross-channel flexibility after the pandemic. While Canadians are more forgiving towards organizations that have a bad shopping experience, with 64% stating they will stop shopping with said retailers vs the global average of 70% – that doesn’t mean there aren't significant areas of improvement available for merchants.

To deliver a consistent and streamlined customer journey across different platforms, you need to connect the dots. That's where unified commerceunified commercecomes in. 44% of global businesses stated that a benefit of unified commerce has increased customer loyalty.

“We can deliver a unified experience and provide a smoother checkout process with mobile checkout and endless aisle capabilities. It also means we can extend digital into physical retail by connecting our in store to our online ecosystem. This will allow us to get a full understanding of our customers’ shopping behaviours and actionable insights.”

3. Technology is key when building customer loyalty

Delivering a cohesive cross-channel experience to your customers is only the beginning. Rather than solely focus on enabling shoppers to buy across channels, you can maximize customer loyalty and make data-driven decisions if you feed payments from all your channels into the same system. You can gain insights into customer segments and behaviour in almost real time by keeping an eye on payment data. With these insights, you can recognize returning customers, remember product and payment preferences, streamline checkout, make personalized offers, and provide rewards for repeat business.

An area that holds great promise is creating payment-linked loyalty programs that automatically recognize and reward return customers with personalized rewards. To build loyalty, Canadians would prefer programs that require little barriers to join or utilize. In fact, 56% of customers would be more likely to use a retailers loyalty program if it automatically linked with their payment card.

With the correct technological setup, you can allow your customers to reap the benefits of loyalty programs automatically rather than work with outdated loyalty cards or other schemes.

4. Physical stores aren’t dead, but need a tech makeover

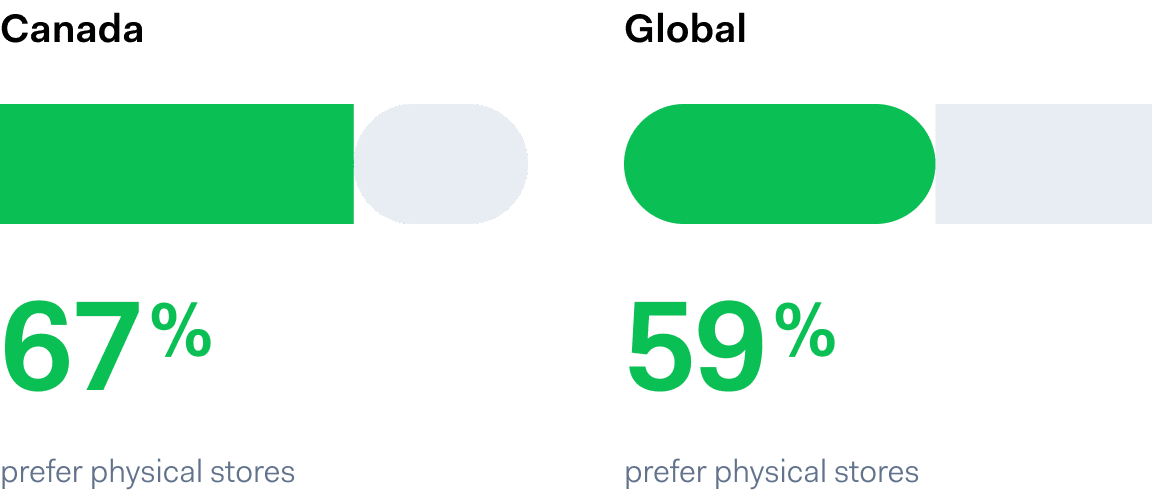

Absence makes the heart grow fonder. After a prolonged period of limited access to physical stores, customers have a renewed appreciation for shopping offline. Canadians remain particularly enticed by in-store experiences. Reflecting this sentiment, 67% of Canadians prefer to shop in a physical store – compared to the global average of 59%. Further, 64% of global customers say physical stores are an important touchpoint, even if they shop with the same retailer online.

There's a catch, though. Rather than visiting just any old store, the same amount of consumers thinks stores need to be exciting places to visit. Places that offer more than goods and services. Stores that use technology to improve and streamline the shopping experience.

You might wonder how? In Canada, online shopping and in-store experiences aren’t in competition with one another, rather, they’re complimentary. Shoppers prefer stores to have both an online and brick-and-mortar presence, that allows for the utilization of retail associates expertise.

By utilizing technology––such as offering quicker payment processing, ordering out-of-stock products, and synced card loyalty programs––Canadians prefer that the customer experience flows across channels seamlessly. Cross-channel experiences have never been more vital to ensuring shoppers' loyalty and staying one step ahead of the competition.

5. Make informed operational decisions with payment data

Thanks to the wealth of payment data, you can spot and respond to trends and changes as they happen. By gaining insights into things like customer preferences, purchase trends, wait times and peak times, you can adapt your marketing campaigns, inform inventory management, or adjust staff rosters to make the most of emerging opportunities.

If you're planning to use payment data to make informed decisions, there are some things to consider. Both regulations and consumers demand you use data responsibly by conforming to local and global data protection laws and asking customers for express permission about their data usage.

But the benefits will be worth your while. Once a customer likes buying from you, it's likely to lead to return purchases and customer retention. Currently, only 18% of Canadian businesses use real-time payment data to help with inventory planning. This percentage increases to 23% when it comes to identifying popular products or product lines – leaving a lot of room for growth opportunity.

The future of retail is bright in our post-pandemic reality

What started as a fallback during the pandemic, has proven to be the key to growth. By harnessing the power of technology and digital transformation, companies in the retail, hospitality, and F&B sectors worldwide have laid the groundwork for a new era of commerce. An era where customer purchase journeys flow seamlessly across platforms.

If you want to read more about our most significant insights on digital transformation, dig deeper into consumer expectations, and discover how unified commerce can help your business grow, download the Adyen Canadian Retail Report 2022 now:

The Adyen Canadian Retail Report 2022

Discover the trends and tech shaping the industry for 2022 and beyond.

Download the insightsFresh insights, straight to your inbox

By submitting your information you confirm that you have read Adyen's Privacy Policy and agree to the use of your data in all Adyen communications.